#volvo brochures

Explore tagged Tumblr posts

Text

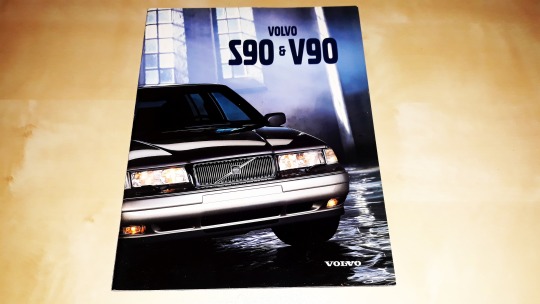

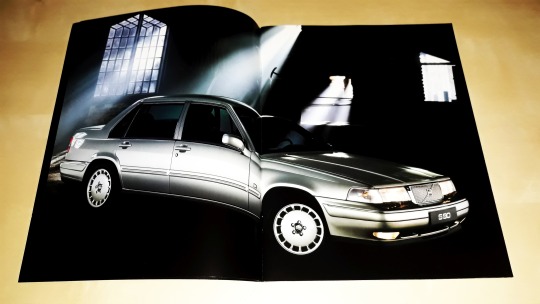

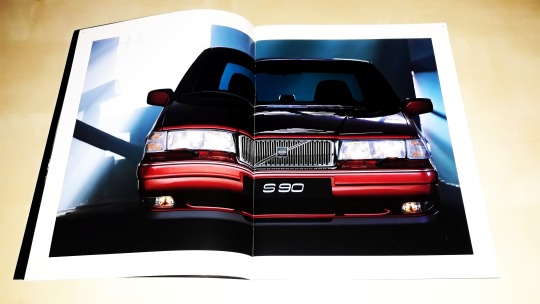

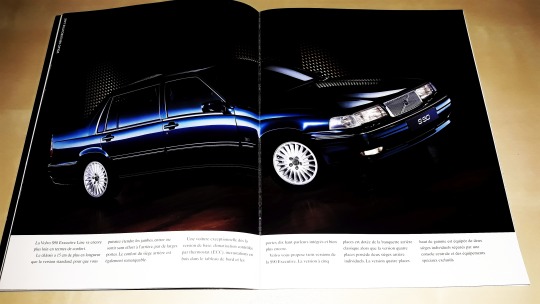

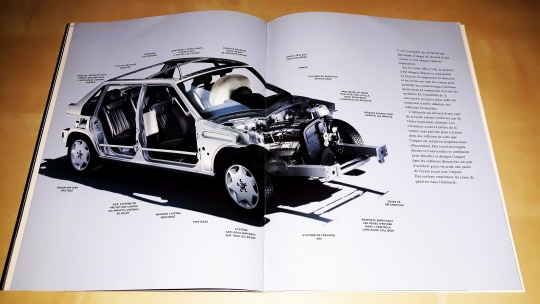

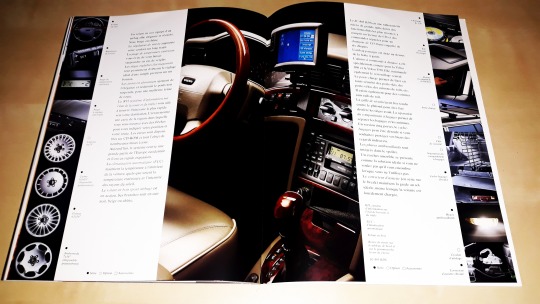

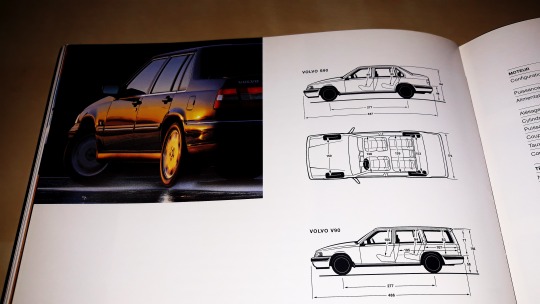

Volvo S90 & V90 1997 brochure

#volvo s90#volvo#prospekty#prospektysamochodowe#salesbrochure#brochures#prospekte#carbrochure#carbrochures#cars#volvo cars#vehicle#car#automobiles

0 notes

Photo

Couverture de brochure International 1968 - Volvo 1800 1968. - source Heikki Siponen.

94 notes

·

View notes

Text

Automotive Operating System Market Set to Reach $25.8 Billion by 2030

The global automotive operating system market is projected to grow from USD 12.7 billion in 2022 to USD 25.8 billion by 2030, at a CAGR of 9.2%. Parameters such as increasing sales for premium cars, paired with rising adoption of ADAS technology by automotive OEMs are expected to support the revenue growth of the automotive operating system market during the forecast period. Further, developments in autonomous vehicles, coupled with increasing penetration of electric vehicles will create lucrative opportunities for the automotive operating system market. The major players in the automotive operating system market are BlackBerry Limited (Canada), Automotive Grade Linux (US), Microsoft Corporation (US), Apple Inc. (US), and Alphabet Inc. (US). These companies have strong product portfolio that offer automotive operating system such as Linux, Android, and QNX, among others to automotive OEMs. These companies have adopted growth strategies such as partnerships, collaborations, and mergers & acquisitions to gain traction in the global automotive operating system market. Asia Pacific is projected to be the largest automotive operating system market (ICE) by 2030. In this region, countries such as China, Japan, and South Korea are expected to take the lead in autonomous driving technology in the coming years. Leading automotive manufacturers in this region, such as Toyota, Honda, and Hyundai, leverage the advantages of safety systems and have made essential safety features a standard across their models. Improving socio-economic conditions in emerging nations, such as India, have also resulted in an increased demand for premium segment passenger cars, which, in turn, increases the demand for advanced features such as driver assistance systems, thereby driving the automotive operating system market in this region. Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=257628775

The automotive operating system market (ICE) in Europe is also expected to witness significant growth during the forecast period. The European market includes France, Germany, Spain, Italy, the UK, and the Rest of Europe and has major OEMs. Some major OEMs in the European region, such as Volkswagen (Germany), Daimler (Germany), and Volvo (Sweden), are pioneers in advanced automotive technologies. The rising penetration of autonomous vehicles would also support the growth of the automotive operating system market in this region. This, in turn, will drive the European automotive operating system market during the forecast period.

The passenger cars segment is estimated to account for a larger share in terms of value in the global automotive operating system market. The increasing development of autonomous vehicles, in conjunction with the rising demand for passenger cars in emerging and developed countries, has contributed to the growth of the passenger car segment of the global automotive operating system market during the forecast period.

Key Market Players:

The automotive operating system market is dominated by major players including BlackBerry Limited (Canada), Automotive Grade Linux (US), Microsoft Corporation (US), Apple Inc. (US), and Alphabet Inc. (US). These companies offer automotive operating system and have strong distribution networks at the global level. These companies have adopted extensive expansion strategies; and undertaken collaborations, partnerships, and mergers & acquisitions to gain traction in the automotive operating system market.

Get Free Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=257628775

0 notes

Text

Diesel Genset Market 2024 Competitive Landscape, Industry Analysis, Segmentation And Forecast To 2034

The Diesel Genset market report offered by Reports Intellect is meant to serve as a helpful means to evaluate the market together with an exhaustive scrutiny and crystal-clear statistics linked to this market. The report consists of the drivers and restraints of the Diesel Genset Market accompanied by their impact on the demand over the forecast period. Additionally, the report includes the study of prospects available in the market on a global level. With tables and figures helping evaluate the Global Diesel Genset market, this research offers key statistics on the state of the industry and is a beneficial source of guidance and direction for companies and entities interested in the market. This report comes along with an additional Excel data-sheet suite taking quantitative data from all numeric forecasts offered in the study.

Get Sample PDF Brochure @ https://www.reportsintellect.com/sample-request/2911295

Key players offered in the market: Caterpillar Kohler Cummins MTU Volvo MHI Briggs Stratton Kipor Power Generac Dresser_Rand MultiQuip

Additionally, it takes account of the prominent players of the Diesel Genset market with insights including market share, product specifications, key strategies, contact details, and company profiles. Similarly, the report involves the market computed CAGR of the market created on previous records regarding the market and existing market trends accompanied by future developments. It also divulges the future impact of enforcing regulations and policies on the expansion of the Diesel Genset Market.

Scope and Segmentation of the Diesel Genset Market

The estimates for all segments including type and application/end-user have been provided on a regional basis for the forecast period from 2024 to 2034. We have applied a mix of bottom-up and top-down methods for market estimation, analyzing the crucial regional markets, dynamics, and trends for numerous applications. Moreover, the fastest & slowest growing market segments are pointed out in the study to give out significant insights into each core element of the market.

Diesel Genset Market Type Coverage: - <60 Kw 60-300 Kw >300 Kw

Diesel Genset Market Application Coverage: - Land Diesel Genset Marine Diesel Genset

Regional Analysis:

North America Country (United States, Canada) South America Asia Country (China, Japan, India, Korea) Europe Country (Germany, UK, France, Italy) Other Countries (Middle East, Africa, GCC)

Also, Get an updated forecast from 2024 to 2034.

Discount PDF Brochure @ https://www.reportsintellect.com/discount-request/2911295

The comprehensive report provides:

Complete assessment of all opportunities and threats in the global market.

Diesel Genset Market recent advancements and major events.

A thorough study of business policies for the growth of the Diesel Genset Market leading players.

Concluding study about the growth plot of Diesel Genset Market for upcoming years.

Detailed understanding of Diesel Genset Market particular drivers, restraints, and major micro markets.

Favorable impression inside vital technological and market latest trends hitting the Diesel Genset Market.

Reasons to Purchase Diesel Genset Market Research Report

Develop a competitive approach based on the competitive landscape

Build business strategy by identifying the high growth and attractive Diesel Genset market classifications

Identify potential business partners, gaining targets and business buyers

Design financial investment policies based on estimated high potential segments

Prepare management and tactical presentations using the Diesel Genset market data

Plan for new product promotion and portfolio in advance

Covid-19 Impact Analysis: Our research analysts are highly focused on the Diesel Genset Market covid-19 impact analysis. A whole chapter is dedicated to the covid-19 outbreak so that our clients get whole and sole details about the market ups & downs. With the help of our report the clients will get vast statistics as to when and where should they invest in the industry.

About Us: Reports Intellect is your one-stop solution for everything related to market research and market intelligence. We understand the importance of market intelligence and its need in today's competitive world.

Our professional team works hard to fetch the most authentic research reports backed with impeccable data figures which guarantee outstanding results every time for you.

Contact Us: [email protected] Phone No: + 1-706-996-2486 US Address: 225 Peachtree Street NE, Suite 400, Atlanta, GA 30303

#Diesel Genset Market#Diesel Genset Market trends#Diesel Genset Market future#Diesel Genset Market size#Diesel Genset Market growth#Diesel Genset Market forecast#Diesel Genset Market analysis

0 notes

Text

Marine Propeller Market Overview, Sales, Revenue, And by 2027 Worth USD 5.68 billion , exhibiting a CAGR of 6.76%

The marine propeller market size stood at USD 3.48 billion in 2021. The market is anticipated to rise from USD 3.60 billion in 2022 to USD 5.68 billion by 2029 at 6.76% CAGR during the forecast period. This study includes brief information about key products in the global marine propeller market followed by an overview of important segments and manufacturers. It also highlights the marine propeller industry growth rates, different types, and application. Furthermore, it includes information about study objectives and total years considered for the complete research study.

Get Sample PDF Brochure:

Fortune Business Insights™ has delved into these insights in its latest research report titled, “Marine Propeller Market, 2022-2029.” According to the analysis, technological advancements and the adoption of fixed propellers in marine propulsion systems will foster the product adoption. With the trend for real-time data tracking in the marine propulsion system, penetration of environment-friendly propulsion systems will bode well for the industry outlook. However, the Russia-Ukraine war could have a notable influence in the ensuing period.

Report Coverage

The report provides a holistic view of the market size, share, volume, and revenue. It has also delved into Porters’ Five Force analysis and SWOT analysis. The report has been prepared through qualitative and quantitative analysis to bolster the strategic approach. The primary interviews have been used to validate assumptions, findings, and the prevailing business scenarios. The report has also been prepared through secondary resources such as annual reports, press releases, white papers, and journals.

Major Players Profiled in the Report:

AB Volvo (Sweden)

Brunswick Corporation (U.S.)

Kongsberg Gruppen (Norway)

Mecklenburger Metallguss GmbH (Germany)

Bruntons Propellers Ltd. (U.K.)

Hyundai Heavy Industries Co., Ltd. (South Korea)

Kawasaki Heavy Industries, Ltd. (Japan)

MAN SE (Germany)

NAKASHIMA PROPELLER Co., Ltd. (Japan)

Rolls-Royce plc (U.K.)

SCHOTTEL Group (Germany)

Michigan Wheel Holdings LLC (U.S.)

Wärtsilä Corporation (Finland)

VEEM Propellers Ltd. (Australia)

Andritz AG (Austria)

Drivers and Restraints

Rising Footfall of Seaborne Trade to Augment Industry Growth

Amidst the onslaught of the COVID-19 pandemic, a gradual rise in seaborne trade has spurred marine propeller market share. Industry players expect developing economies to play an invaluable role in fueling the demand for marine propeller systems. According to UNCTAD, developing countries’ share in maritime imports surged to 65% in 2019, while seaborne trade stood at 155 million tons. Moreover, UNCTAD’s Maritime Transport Report 2020 projected seaborne trade growth would expand by 4.8% in 2021. Notable investments in the naval sector across advanced and emerging economies will expedite the adoption of the equipment.

However, rigorous environmental regulations may challenge leading companies vying to expand their portfolios.

Segments

In terms of type, the market is segmented into thrusters, propellers, and others.

Based on application, the market is segregated into naval ships, merchant ships, recreational boats, and others.

On the basis of number of blades, the market is fragmented into 5-blade, 4-blade, and 3-blade.

With respect to propulsion, the market includes sterndrive, inboard, outboard, and others.

With regards to material, the market is segmented into aluminum, stainless steel, nickel-aluminum bronze, bronze, and others.

In terms of end-user, the market is segregated into aftermarket and OEM.

On the geographical front, the market covers North America, Asia Pacific, Europe, and the Rest of the World.

Regional Insights

Robust Demand for Frigates and Corvettes to Propel Asia Pacific Market Growth

Asia Pacific is likely to emerge as a happy hunting ground on the back of surging demand for frigates and corvettes. The strong demand is mainly attributed to boosting naval fleet operation and procurement initiatives. Upgrade of marine propeller design systems has become pronounced across South Korea, China, Japan, and India. The Asia Pacific market size was valued at USD 1.21 billion in 2021 and will grow owing to rising demand for advanced amenities.

The North America marine propeller market growth will witness an appreciable gain on the back of the thriving marine sector in the U.S. and Canada. Upgrade of dry cargos for real-time data exchange will propel regional growth. Prominently, strong demand for specialized vessels in maritime tourism will fuel the market growth.

Stakeholders expect Europe to provide lucrative growth opportunities on the back of the presence of leading companies across the U.K., France, Russia, and Germany. Moreover, bullish demand for cruise ships will bode well for the regional growth.

Competitive Landscape

Stakeholders Bolster Product Offerings to Tap Markets

Stakeholders are poised to infuse funds into product rollouts, technological advancements, and mergers & acquisitions. Well-established players and new players could invest in R&D activities to gain a competitive edge. Further, investments in geographical expansion could be pronounced over the next few years.

Key Industry Development

March 2020: SCHOTTEL awarded a contract to supply propulsion units for two double-ended Ro-Pax ferries by Ada Shipyard.

0 notes

Text

First 345, un voilier moderne au style classique

La gamme First fait partie de l’ADN du chantier Bénéteau. C’est avec cette gamme de voiliers que le chantier vendéen se lance véritablement dans la voile pure et casse son image de Fifty, avec ses Evasions. Le First 345 est un des voiliers qui représente le mieux la réussite de la gamme First et son caractère bien définie.

First 345, un First nouvelle génération

La gamme First est arrivée à la fin des années 70, avec le First 30 d’André Mauric. Rapidement, la gamme se développe avec différents modèles et connait un véritable succès populaire. A partir de 1983, Bénéteau décide de renouveler l’ensemble de sa gamme de course-croisière. C’est dans ce contexte que sort, en 1984, le First 345. Jean Berret, qui avait déjà dessiné, avec succès, les First 32 et 38, sera contacté pour ce nouveau voilier de 10 mètres. Et le résultat sera à la hauteur des ambitions du chantier. Sur le marché de l’occasion, le First 345 n’est pas le bateau le plus recherché ni le plus populaire. Pourtant c’est un voilier qui marque bien la transition entre bateaux de mer et l’arrivée de la priorité donnée au volume habitable. Le First 345 est un voilier moderne et classique en même temps. Pour commencer, avec ce First345, finit la couleur crème des débuts du chantier. Le blanc fait son apparition. Le First 345 est ure voilier de course-croisière. Son franc-bord reste encore modéré et son roof en sifflet assez discret. Ce qui en fait un bateau très élégant sur l’eau. Il est sans doute un des 10 mètres les plus élégants de son époque. Certains diront qu’il est un peu moins moderne qu’un Feeling 1040, voire 1090 arrivé 3 ans plus tard ou encore le Sun Rise, du concurrent direct Jeanneau. C’est sans doute, en partie vrai, pour l’aspect confort. Mais quelle classe et quel tempérament sur l’eau. Le First 345 sera construit à 80 exemplaires entre 1984 et 1988. Il sera remplacé par le First 35S5, signé encore une fois par Jean Berret et désigné par Philippe Starck. Son grand frère, le First 375, fait partie des meilleurs voiliers de 13 mètres de sa génération.

Un voilier rapide et marin

Photo Brochure Bénéteau Comme tous les plans Berret, le First 345 est un excellent bateau. Très typé cours-croisière, le bateau se montre rapide, quel que soient le temps et l’état de la mer. Il est capable de faire un excellent près et est raid à la toile. La barre est très agréable et le bateau pas trop technique. Bien évidemment, la version GTE, avec 1.90m de tirant d’eau sera la plus performante que la version PTE, avec 1.45m. Le First 345 est généralement équipé d’un moteur de 28ch, Volvo. Cependant, certaines versions, pensées pour la régate, sont équipées d’un moteur de 9ch. Ce moteur semble trop faible pour de la croisière.

Le confort en mer

Photo Brochure Bénéteau Le First 345 est un voilier pensé pour naviguer et vivre en mer. Dès sa sortie, il est proposé en version 2 ou 3 cabines. Sur la version 2 cabines, le coin toilette est situé au pied de la descente. Dans la version à deux cabines arrière, le coin WC est situé entre le carré et la cabine avant. Les deux versions ont leurs adeptes. Du volume dans les cabines d’un côté et une troisième cabine pouvant aussi servir de local technique pour les autres. Quoi qu’il en soit, le bateau est très agréable à l’intérieur. Les boiseries sont de très belle qualités et très présentes. L’espace est bien organisé et un côté du carré, en L, permet de dégager une coursive pour passer vers la cabine avant. Enfin les tables à cartes sont encore de belles tailles à cette époque et le coin cuisine bien organisé.

Notre avis sur le First 345:

Pour résumer, un First 345 d'occasion sera un excellent choix pour naviguer sur un voilier élégant, costaud et marin, capable d'aller partout.

Fiche technique Bénéteau First 345 :

- Longueur : 10,55m - Longueur de flottaison : 9,08m - Largeur : 3.50m - Tirant d’eau : 1,90m ou 1,40m - Surface de voiles : 69m² - Moteur : 18 ou 9 ch - Poids : 5700kg - Lest : 2050kg

Read the full article

0 notes

Photo

Volvo 1800 S brochure, 1964. The Volvo P1800 was introduced in 1961. Because Volvo lacked production capacity the first cars were built by Jensen Motors in the UK using bodywork fabricated at Linwood in Scotland by Pressed Steel. Quality control issues meant that in 1963 production was moved to Volvo's Lundby Plant in Gothenburg and the car's name was changed to 1800 S with the S standing for Sverige, or in English, Sweden.

187 notes

·

View notes

Photo

Volvo P1800S Car Brochure (1966)

208 notes

·

View notes

Text

“A couple of days after I passed my test, Freddie, Joe and the others were sitting around in the kitchen. Terry came in through the garden with a twinkle in his eye. Freddie had secretly asked him to scout around and find me a car.

Freddie called me into the kitchen. On the table were some glossy brochures for a Volvo 740 GLE estate. ‘Here, pick a colour,’ said Freddie. He was serious. Mary objected to Freddie buying me this particular car. She felt it wasn’t wise for my first one to be brand-new. I thought she was talking a lot of sense. But Freddie would have none of it.

‘For God’s sake,’ he said to her. ‘It’s his birthday present. He gets a new car.’ ”

My favourite Mercury & Me moments (part 17/?)

#jimercury#freddie mercury#jim hutton#jimercury meme#mercury and me#queen#queen band#she’s a killer queue

90 notes

·

View notes

Text

Volvo 340 R Sport brochure

#volvo 340#volvo 340 r#volvo#prospektysamochodowe#salesbrochure#brochures#prospekty#carbrochures#carbrochure#prospekte#cars

0 notes

Photo

Brochure Allemande 1969 - Volvo 121/122 S. - source Heikki Siponen.

58 notes

·

View notes

Photo

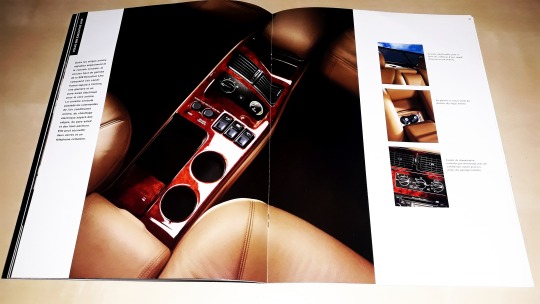

Short News: The Beautiful Volvo XC90 Excellence Lounge Console launched at Rs 1.42 crore https://ift.tt/2Zvg8kJ

0 notes

Text

Graphic Design task 3-Examples of poster design

1. Typography only- Abbott Miller- Brno Echo, 2008

2. Image only- Bo Lundberg- Volvo Brochure 2019

3. Type and image together- Victor Moscoso- Junior Wells and his Chicago Blues Band, 1966

5 notes

·

View notes

Photo

Volvo 164 brochure, 1970. The 164 was launched at the Paris Motor show in October 1968, it was Volvo’s first 6-cylinder luxury car since the PV800 of the 1950s. It was the beginning of a line of large Volvo saloons that carries on through to today’s S90

144 notes

·

View notes

Photo

Venturi 400 GT Trophy - 1994 by Perico001 RM Sotheby's Place Vauban Parijs - Paris Frankrijk - France February 2019 Estimated : € 120.000 - 200.000 Sold for € 132.250 Looking to compete with the sports car establishment, Venturi was founded by Claude Poiraud and Gérard Godfroy in the 1980s and their first car took to the streets in 1986. Venturi’s most exciting car, the 400 GT, was introduced in 1992. With performance to match its looks, the 400 GT was not only the most powerful car ever built in France at the time of its introduction, but the first production car with carbon ceramic brakes as standard. Boasting a V-6 engine developed jointly by Peugeot, Renault and Volvo producing 400 bhp, performance was astounding, especially when considering it weighed under 1,200 kg, some 225 kg less than a Ferrari F355. Ordered new by Hervé Poulain, Honorary Chairman of the auction house Artcurial and the man behind BMW’s art cars, Poulain purchased this car, the 25th Venturi built, in 1992. The following year, it received fascinating new paintwork by Jean-Yves Lacroix, which was inspired by the perfume ‘Pasha de Cartier’ and in this livery saw frequent use throughout the 1993–1995 seasons where it was driven by both Poulain and former Formula One driver Oliver Grouillard. During this time, the car was also featured in the Venturi brochure to promote the 400 GT. The car is also featured in Poulain’s book about his racing cars, Mes Pop Cars. Following the end of the Venturi’s racing career, the car was converted to road-going specifications and sold to a Mr Strub in Strasbourg and was subsequently purchased by the third and current owner in 2008 and imported to Germany. Since then, the car has been well preserved in the consignor’s collection. A service in October of 2018 included a replacement of the clutch release bearing, as well as new brake linings and a new starter. It is accompanied today by an extensive history file, which includes the original Certificat d’Immatriculation from Hervé Poulain’s ownership. Without a doubt one of France’s most exciting cars of the 1990s, this is a Venturi with uniquely French history that would make a wonderful entry into the new Masters Endurance Legends series. https://flic.kr/p/2eKBthR

1 note

·

View note